Maryland Ready-to-Drink (RTD) Cocktails

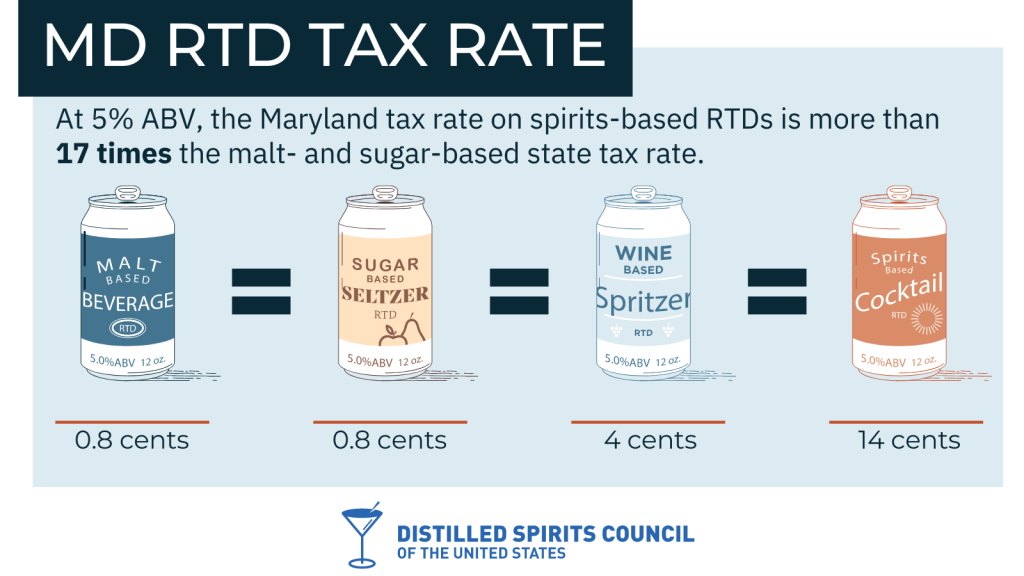

DYK: Your favorite spirits RTD cocktails are being taxed 17 TIMES HIGHER than beer RTDs with the same alcohol content!

It’s time to modernize Maryland laws to provide fairer tax treatment for spirits RTDs!

While the variety of RTDs has greatly increased consumer choice, consumers of spirits-based RTDs products are being unfairly burdened by higher taxes. For example, at 5% alcohol by volume, the Maryland tax rate on spirits-based RTDs is 17 TIMES the malt- and sugar-based state tax rate.

This state-level tax disparity is ON TOP OF a federal-level tax disparity, where spirits RTDs are taxed at MORE THAN TWICE the rate of beer- and wine-based RTDs.

All of this excessive tax burden falls squarely on local producers trying to enter this growing category and consumers like you. Despite growing demand for spirits RTDs, a recent DISCUS survey found that nearly two-thirds (62%) of craft spirits distillers say they are not producing spirits RTDs due to these higher tax rates, which create a barrier to entry in the market.

Fair tax treatment will boost small businesses, including the 38 craft distilleries in Maryland and support consumer choice!

Take action NOW by respectfully asking your legislators to support HB 663 which lowers the tax burden on ready-to-drink cocktails in Maryland.